Dare Babalola

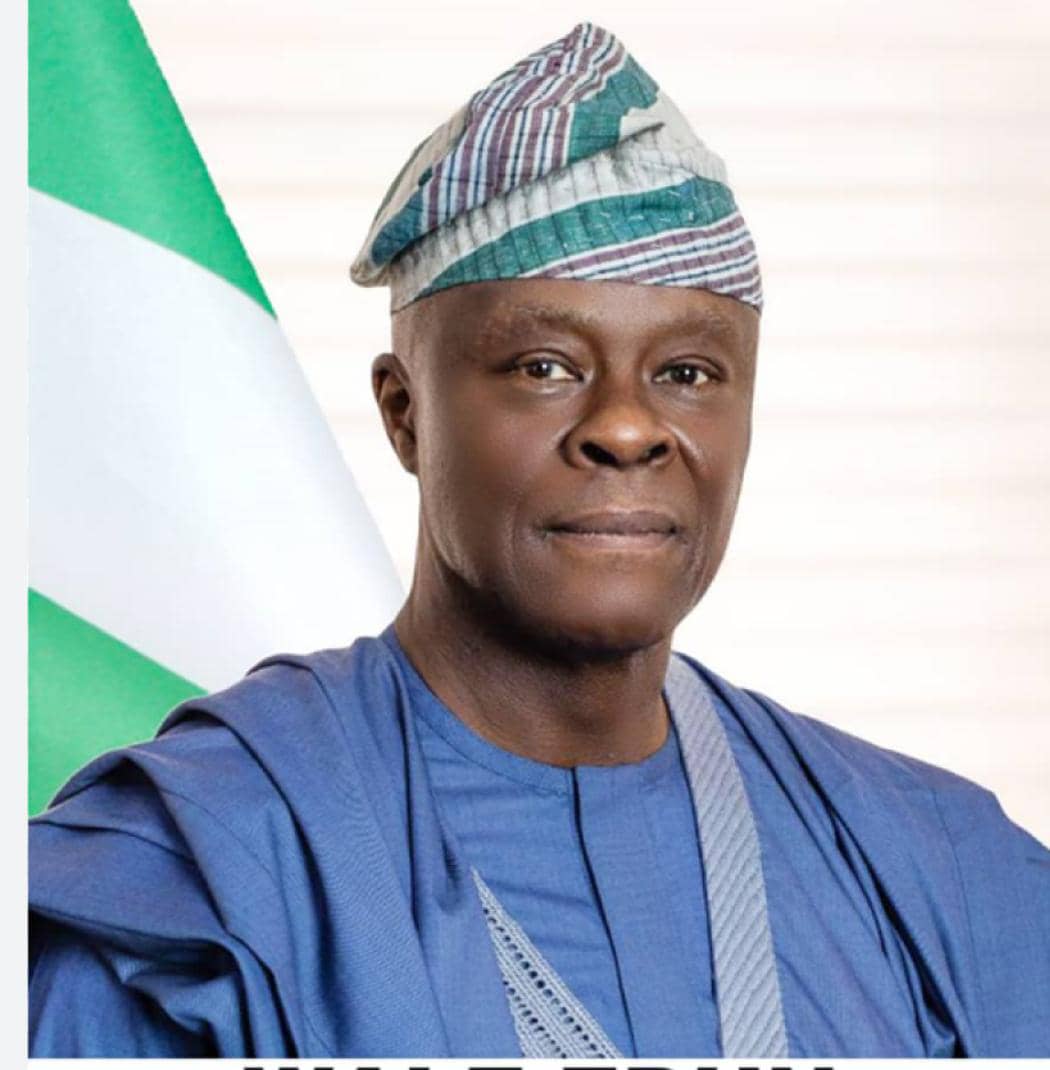

A heated debate has erupted between Nigeria’s Minister of Finance, Wale Edun, and Speaker of the House of Representatives, Abbas Tajudeen, over the country’s debt profile.

According to Abbas, Nigeria’s total public debt has skyrocketed to N149.39 trillion (approximately $97 billion) in the first quarter of 2025.

Abbas raised alarm over Nigeria’s rising debt profile, warning that it has crossed the country’s statutory threshold and now threatens fiscal sustainability.

The Speaker made the remarks on Monday at the opening of the 11th Annual Conference and General Assembly of the West Africa Association of Public Accounts Committees (WAAPAC), held at the National Assembly, Abuja.

The conference, which brought together parliamentarians from across West Africa, development partners, and financial experts, focused on the theme: “Strengthening Parliamentary Oversight of Public Debt: The Role of Finance and Public Accounts Committees.”

Abbas noted, “Even more concerning is the debt-to-GDP ratio, which now stands at roughly 52 percent, well above the statutory ceiling of 40 percent set by our own laws.”

He described the breach of the debt limit as “a signal of strain on fiscal sustainability,” stressing the need for “stronger oversight, transparent borrowing practices, and a collective resolve to ensure that tangible economic and social returns match every naira borrowed.”

To address these risks, Abbas announced that Nigeria is prepared to champion the establishment of a West African Parliamentary Debt Oversight Framework under WAAPAC.

The framework, he explained, would harmonise debt reporting across the sub-region, set transparency standards, and empower parliaments with timely data to scrutinise borrowing practices.

“Borrowing should support infrastructure, health, education, and industries that create jobs and reduce poverty.

“Reckless debt that fuels consumption or corruption must be exposed and rejected. Oversight is not just about figures, but about the lives and futures behind those figures,” he said.

He said that under its Open Parliament policy, major borrowing proposals would be subjected to public hearings, while simplified debt reports would be made available to citizens.

However, Edun reassured that Nigeria was turning the corner under President Bola Tinubu’s reforms.

Noting that revenues rose by 34.7 per cent in the first half of 2025, the minister said the country’s debt service-to-revenue ratio dropped to about 60 per cent in 2024, while the debt-to-GDP ratio stood at 38.8 per cent, a level he described as comfortable compared to global benchmarks.

He acknowledged that Nigeria, like many countries in West Africa, faces significant fiscal challenges, including elevated debt service costs, constrained revenues, and rising demands for public spending.

“Nigeria is turning the corner. The reforms are delivering measurable impact in terms of investor confidence, reduced spending on fuel imports, greater energy self-sufficiency, and value addition in our economy,” Edun said.

Edun credited the gains to tough but necessary policy choices such as the removal of fuel subsidies, liberalisation of the exchange rate, and the roll-out of a comprehensive tax reform programme aimed at boosting efficiency, simplifying compliance, and raising Nigeria’s tax-to-GDP ratio over time.

According to him, these reforms are essential for creating a predictable macroeconomic environment that encourages private investment, which accounts for about 90 per cent of economic activity.

“Government’s role is to act as a catalyst, not to crowd out the private sector. With the right fiscal discipline, we can unlock opportunities and ensure inclusive growth that lifts millions out of poverty,” he said.

On Nigeria’s fiscal direction, the minister outlined priorities including debt transparency, growth-enhancing borrowing, domestic revenue mobilisation, and prudent budgeting within the limits set by the Fiscal Responsibility Act.

He said the government is committed to project-linked borrowing that yields direct returns and avoids reliance on money-printing or unsustainable financing.

Edun also drew attention to global headwinds, such as shrinking development aid, reduced world trade, and rising international interest rates, that have made fiscal management more difficult for developing economies.

He said these challenges underscore the need for African countries to be more self-reliant by embracing reforms, technology, and digitisation to strengthen revenue generation.

The minister emphasised that parliamentary oversight is central to maintaining fiscal discipline.

He urged lawmakers to hold governments accountable for borrowing and spending decisions, insisting that transparency and accountability must underpin every fiscal framework.

“A sound fiscal framework is not just the responsibility of the executive; it demands partnership, leadership, and rigorous oversight from parliamentarians such as you, especially public accounts and finance committees,” Edun said.

He described Nigeria’s fiscal trajectory as a turning point, with reforms providing the foundation for stability, competitiveness, and inclusive growth.

He stressed that prudent borrowing, transparent reporting, and effective oversight must be sustained to secure prosperity for future generations.